In today’s digital era, many businesses rely on software subscriptions to manage their day-to-day operations, improve productivity, and stay competitive. From project management tools to accounting software, these subscriptions are often an essential part of business operations. However, questions often arise regarding whether businesses need to issue a 1099 form for software subscriptions.

No, you usually don’t issue a 1099 for software subscriptions since they’re considered payments to corporations. However, consult a tax professional for specific cases.

This article delves into the relationship between 1099 forms and software subscriptions, provides a clear understanding of tax obligations, and offers detailed insights into best practices for businesses in the U.S.

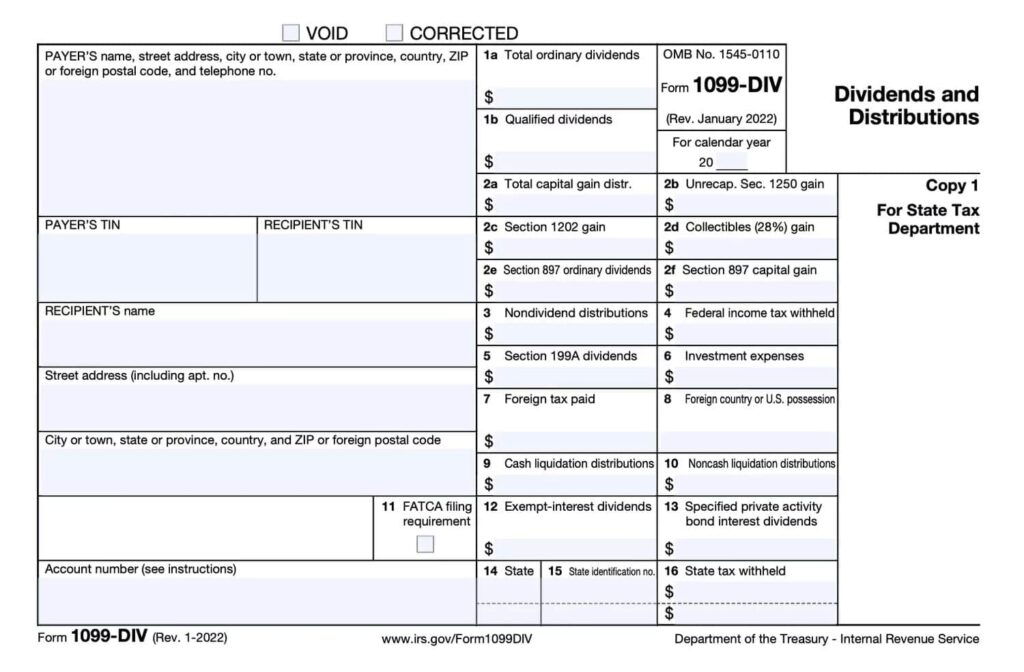

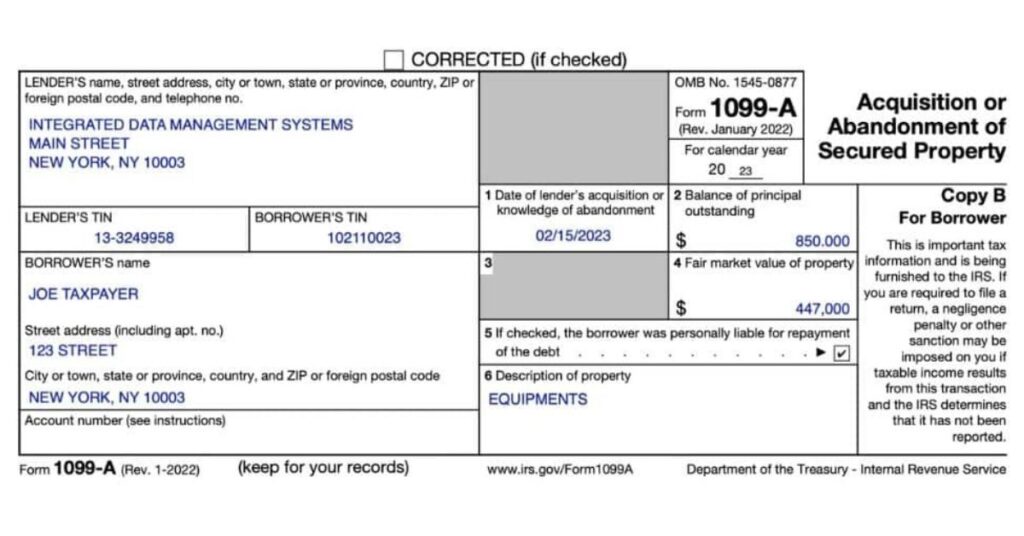

What is a 1099 Form?

A 1099 form is an IRS (Internal Revenue Service) tax form used to report payments made by a business to independent contractors, freelancers, or any entity that is not an employee. There are various types of 1099 forms, each catering to specific payment categories. The most commonly used form is the 1099-NEC (Nonemployee Compensation), which reports payments to non-employees for services rendered.

1. Common Uses of the 1099 Form

- Independent Contractors: When a business pays a freelancer or contractor $600 or more in a calendar year, a 1099 form must be issued.

- Professional Services: Payments to accountants, lawyers, or other professionals that exceed $600 also require a 1099.

- Rent and Royalties: Other payments, such as rent or royalties, may also trigger the need to issue a 1099 form.

What Qualifies for 1099 Reporting?

Not every payment a business makes requires a 1099 form. In general, 1099 forms are issued for payments made for services, rent, and certain other types of transactions. The key factor is whether the payment is made to an individual, a partnership, or an LLC that is treated as a partnership or sole proprietorship.

1. When Is a 1099 Not Required?

- Incorporated Businesses: Payments to corporations generally do not require a 1099, unless the payments are for legal services.

- Goods and Products: Payments for physical goods do not require 1099 forms.

- Online Marketplaces: Payments made through platforms like PayPal or credit card processors may already be reported on a 1099-K form issued by the platform itself.

Software Subscriptions and 1099 Forms: The Basics

Software subscriptions are classified differently from traditional services. Since these are payments for a product or a service provided by a corporation, the need to issue a 1099 becomes a nuanced topic. In most cases, software subscriptions do not require a 1099 because the payments are for a product or license rather than independent contractor services.

1. Why Software Subscriptions Don’t Typically Require a 1099

- Corporate Providers: Most software subscription services, such as those from major providers like Microsoft, Adobe, and Amazon Web Services, are sold by corporations. Payments to corporations do not require a 1099, with the exception of legal services.

- Licensing, Not Services: Software subscriptions are generally treated as payments for the license to use a product, rather than payment for services. This categorization exempts them from 1099 reporting.

Specific Scenarios Where a 1099 May Be Needed:

While software subscriptions typically don’t require a 1099, certain scenarios might necessitate further examination.

1. Payments to Independent Software Developers

If your business hires an independent developer or freelancer to create custom software or manage a software system, and you pay them $600 or more in a tax year, you would need to issue a 1099 form. These payments fall under “services rendered” and require reporting.

2. Cloud Computing and SaaS Platforms

When businesses use cloud-based software (Software as a Service, or SaaS), the payments are generally considered to be for the product rather than services. If the provider is a corporation, no 1099 is required. However, if the software is provided by an individual or small partnership (rare but possible), and payments exceed $600, a 1099 may need to be issued.

Best Practices for Businesses Regarding Software Subscriptions and 1099 Forms:

Understanding tax obligations surrounding software subscriptions can be confusing, especially when distinguishing between service providers and product vendors. Here are best practices to follow:

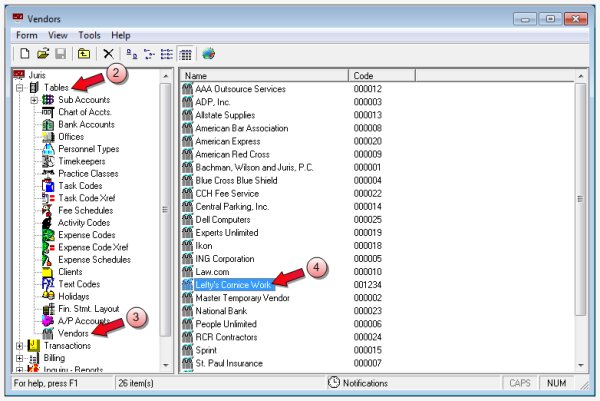

1. Verify Vendor Status

Before issuing any payments, verify whether the software provider is incorporated or operating as an individual or partnership. This can help you determine whether a 1099 is needed.

2. Keep Detailed Records

Maintain comprehensive records of your software expenses, including invoices, subscription details, and contracts. This helps ensure accurate reporting and provides clarity when preparing for tax season.

3. Consult with a Tax Professional

If you’re uncertain about your tax reporting obligations, it’s best to consult with an accountant or tax professional. They can provide personalized advice based on your business operations and help ensure compliance with IRS regulations.

4. Issue 1099s for Service Providers

While software subscriptions generally don’t require 1099s, if you’re paying for services related to the software—such as development, installation, or maintenance from an individual contractor—be sure to issue a 1099-NEC if the payments exceed $600.

5. Review IRS Guidelines Annually

Tax rules can change from year to year. Stay informed about IRS guidelines regarding 1099 forms and software subscriptions by reviewing annual updates from the IRS.

Potential Consequences of Non-Compliance:

Failing to issue a 1099 when required can result in penalties from the IRS. The penalty amount depends on how late the form is filed, with higher penalties for intentionally disregarding the requirement.

1. Penalties for Failing to File 1099 Forms

- Late Filing Penalties: The penalty for late filing varies depending on how late the form is submitted. For example, if the 1099 is filed within 30 days of the due date, the penalty is $50 per form. If it’s filed more than 30 days late but before August 1, the penalty increases to $110 per form.

- Intentional Disregard: If you intentionally fail to file a 1099, the penalty can be as high as $550 per form, with no maximum penalty limit.

- Possible IRS Audits: Inconsistent or incomplete reporting can trigger an IRS audit, which can be costly and time-consuming for your business.

FAQ’s

1. Do I need to issue a 1099 for software subscriptions?

No, in most cases, you do not need to issue a 1099 for software subscriptions, as these payments are typically for products or services provided by corporations.

2. What if I hire an independent software developer?

If you hire an independent developer and pay them $600 or more in a tax year, you will need to issue a 1099-NEC to report those payments.

3. Do SaaS platforms require a 1099 form?

No, most SaaS platforms are provided by corporations, so payments to these providers do not require a 1099.

4. Are there penalties for failing to issue a 1099?

Yes, penalties for failing to file a 1099 range from $50 to $550 per form, depending on how late the filing is and whether it was intentional.

5. How can I verify whether a 1099 is required?

To determine if a 1099 is required, verify the status of the vendor (individual vs. corporation) and consult with a tax professional for guidance.

6. Do I need to issue a 1099 for software maintenance services?

If the maintenance services are provided by an independent contractor and the payments exceed $600, then a 1099-NEC is required.

7. Are online marketplaces responsible for issuing 1099s?

Yes, platforms like PayPal and credit card processors may issue 1099-K forms for payments processed through their services.

8. What type of payments generally require a 1099?

Payments for independent contractor services, rent, royalties, and other non-employee compensation typically require a 1099.

9. Can I be audited for failing to file a 1099?

Yes, inconsistent or incomplete reporting can trigger an IRS audit, which may lead to penalties and additional scrutiny of your business practices.

10. How can I avoid penalties for not filing a 1099?

Stay organized, verify vendor statuses, and file 1099 forms promptly. Consulting a tax professional can also help ensure compliance

Conclusion:

In summary, issuing a 1099 for software subscriptions is generally not required, as most subscriptions are classified as products or services provided by corporations. However, businesses should remain aware of specific scenarios where a 1099 may be necessary, such as when working with independent developers or small partnerships.

By following best practices, verifying vendor status, and consulting with tax professionals, businesses can ensure they remain compliant with IRS regulations and avoid penalties.