When I started my freelance business, I quickly learned about 1099 forms. I paid for some software services, and at the end of the year, I realized I needed to report those payments. Keeping good records made the process much easier, and I felt more confident with my taxes.

Yes, payments for software as a service (SaaS) can be 1099 reportable. If you pay a SaaS provider $600 or more in a year, you need to file a 1099 form, unless the provider is a corporation. Keeping track of these payments helps ensure you follow tax rules properly.

Are Services 1099 Reportable?

When your business pays a SaaS provider $600 or more in a year, you usually need to report that payment using a 1099 form. This is because these payments are often considered services that require reporting. Just remember, if the total adds up, it’s important to keep track! So, stay organized to avoid any tax surprises!

This is because these payments fall under the category of non-employee compensation, which is required to be reported to the IRS. However, if the SaaS provider is a corporation, then you usually do not need to file a 1099 for those services. Thus, understanding whether software as a service 1099 reportable is crucial for compliance with tax regulations.

Always keep accurate records of payments made, as this will help determine if you need to issue a 1099 form. In summary, to know if is software as a service 1099 reportable, consider the amount paid and the type of business you are paying; this ensures you meet your reporting obligations correctly.

Is Software As A Service Taxable?

- Sales Tax May Apply: In many states, software as a service (SaaS) is considered a taxable service, meaning you might need to pay sales tax on the subscription fees.

- Check Local Laws: Tax rules can vary by state, so it’s important to check the specific tax laws in your area to see if SaaS is taxable.

- Exemptions Exist: Some businesses or non-profit organizations may qualify for tax exemptions, depending on their purpose or the nature of the software.

- Billing Practices Matter: If you are charged for additional features or services within the SaaS, those charges might also be subject to tax.

- Keep Records: It’s wise to maintain records of your SaaS purchases, as you may need them for tax purposes or audits.

Are Maintenance Contracts 1099 Reportable?

1. What Are Maintenance Contracts?

Maintenance contracts are agreements between a business and a service provider for regular support and upkeep of products or systems. These contracts ensure that the necessary maintenance is performed to keep everything running efficiently, which leads to the question: is software as a service 1099 reportable? By having these contracts in place, businesses can manage costs and ensure compliance, including knowing if is software as a service 1099 reportable for their specific payments.

Understanding the terms of maintenance contracts helps businesses stay informed about their financial obligations, especially regarding whether is software as a service 1099 reportable when paying for these services.

2. When Are Maintenance Contracts 1099 Reportable?

- Payment Threshold: Maintenance contracts are 1099 reportable if you pay $600 or more to a non-employee in a calendar year.

- Type of Service: The payment must be for maintenance services provided by independent contractors or freelancers, not employees.

- Non-Corporate Providers: If the service provider is not a corporation, you typically need to issue a 1099 form for those payments.

- Tracking Payments: Keep accurate records of all payments made for maintenance contracts to ensure compliance with reporting requirements.

3. Exceptions to 1099 Reporting:

There are certain exceptions to 1099 reporting that businesses should be aware of. If the maintenance service provider is a corporation, you generally do not need to issue a 1099 form, as most corporations are exempt from this requirement.

Additionally, payments made for services that are considered qualified expenses, such as certain medical or legal services, might also be excluded from 1099 reporting. It’s essential to understand these exceptions to avoid unnecessary paperwork and ensure compliance with tax regulations.

Is Web Hosting 1099 Reportable?

Web hosting services can be 1099 reportable, depending on certain factors. If your business pays a web hosting provider $600 or more within a year, and that provider is not a corporation, you generally need to issue a 1099 form. This ensures that the IRS is informed about the payments made for these services, which are considered non-employee compensation. Keeping track of these payments is important for accurate tax reporting.

1. Key Points:

- Payment Amount: Web hosting services are reportable if you pay $600 or more in a year.

- Type of Provider: The 1099 form is required if the web hosting service provider is not a corporation.

- Nature of Service: Web hosting is categorized as a service, making it subject to 1099 reporting rules.

- Record Keeping: Maintain detailed records of all payments to ensure compliance with tax obligations.

Are all legal fees 1099 reportable?

Not all legal fees are 1099 reportable, and understanding the rules surrounding this can help businesses remain compliant. Generally, if your business pays $600 or more in legal fees to a non-corporate attorney within a year, those payments need to be reported on a 1099 form.

This applies whether the fees are for litigation, consultations, or any other legal services. However, if the attorney is part of a corporation or a limited liability company (LLC), then you typically do not need to issue a 1099 for those payments.

Additionally, legal fees for certain services, such as personal legal matters unrelated to the business, may also be excluded from 1099 reporting requirements. It’s essential to keep accurate records of all legal fees paid to determine what needs to be reported, as this will help avoid potential issues with the IRS during tax season.

FAQ’s

1. Can I deduct tax software as business expense?

Yes, you can usually deduct tax software as a business expense if it’s used for your business’s tax preparation. This deduction can help lower your taxable income, making your overall tax bill smaller.

2. What is the reporting threshold for 1099-NEC 2024?

The reporting threshold for the 1099-NEC in 2024 is $600. If you pay a non-employee $600 or more for services during the year, you must file a 1099-NEC form to report those payments.

3. Are reimbursements to contractors 1099 reportable?

Reimbursements to contractors are generally not 1099 reportable if they are for expenses incurred on behalf of the business. However, if the reimbursement is part of a payment for services and totals $600 or more, it should be reported on a 1099 form.

4. Can I deduct tax software as business expense?

Yes, you can deduct the cost of tax software as a business expense if you use it for your business’s tax preparation. This deduction helps reduce your taxable income, making it easier to manage your overall tax liability.

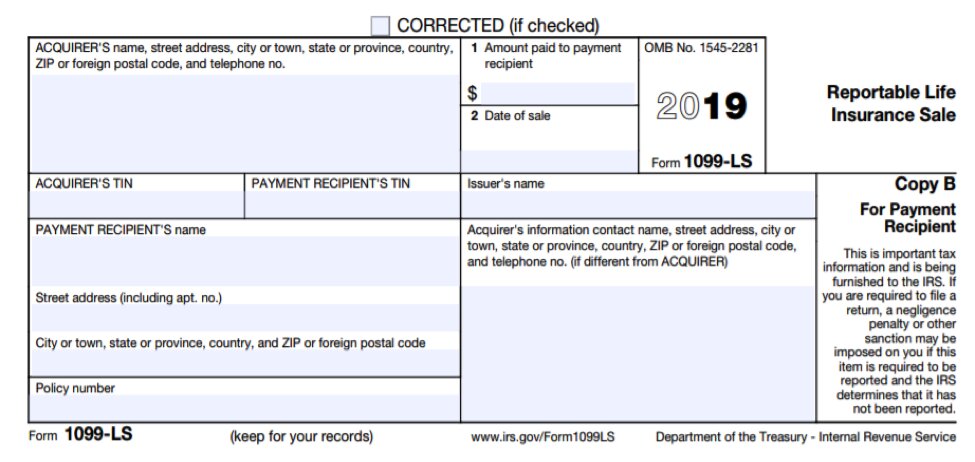

5. When to use 1099-Nec vs Misc?

Use the 1099-NEC form for reporting payments of $600 or more made to non-employees for services, such as independent contractors. The 1099-MISC form is used for other types of payments, like rent or prizes, that don’t fall under the non-employee category.

Conclusion:

Determining if your payments for software as a service (SaaS) need a 1099 form boils down to how much you pay and who you’re paying. If you shell out $600 or more in a year to a non-corporate SaaS provider, you usually have to report that on a 1099.

Knowing these guidelines is key to keeping your business on the right side of tax laws. Stay informed, and you’ll avoid any tax-time headaches!