Using spreadsheet software transformed my approach to budgeting; I felt like I was building a financial roadmap. The colorful charts and easy calculations turned what used to be a chore into an exciting journey toward my savings goals.

Spreadsheet software is more flexible and versatile than financial planning software. It can handle a variety of tasks beyond just finance, making it suitable for many applications. This flexibility allows users to customize their work and analyze data more effectively.

Is Spreadsheet Software More Powerful Than Financial Planning Software?

When it comes to managing finances, spreadsheet software is more powerful than financial planning software for many reasons. One of the key strengths is its flexibility, allowing users to create custom templates and organize data however they want, which shows that spreadsheet software is more powerful than financial planning software for personalization.

It also offers advanced functions like formulas and charts, demonstrating that spreadsheet software is more powerful than financial planning software when performing detailed calculations and data analysis. Furthermore, the ability to scale and handle large amounts of data proves that spreadsheet software is more powerful than financial planning software for growing needs.

Additionally, its collaborative features highlight how spreadsheet software is more powerful than financial planning software for teamwork and real-time sharing. Whether for personal or business use, it’s clear that spreadsheet software is more powerful than financial planning software in terms of flexibility, scalability, and advanced features.

What Type Of Software Is Useful In Financial Planning And Calculation?

1. Financial Planning Software:

Financial planning software helps people organize their finances by offering tools to create budgets, track expenses, and plan for future goals. It often includes features for managing investments, calculating taxes, and preparing for retirement. This software provides templates to guide users in structuring their financial plans more easily. It’s useful for both personal and small business financial management.

2. Spreadsheet Software:

- Offers customizable templates for tracking income, expenses, and savings.

- Supports advanced calculations using formulas and functions.

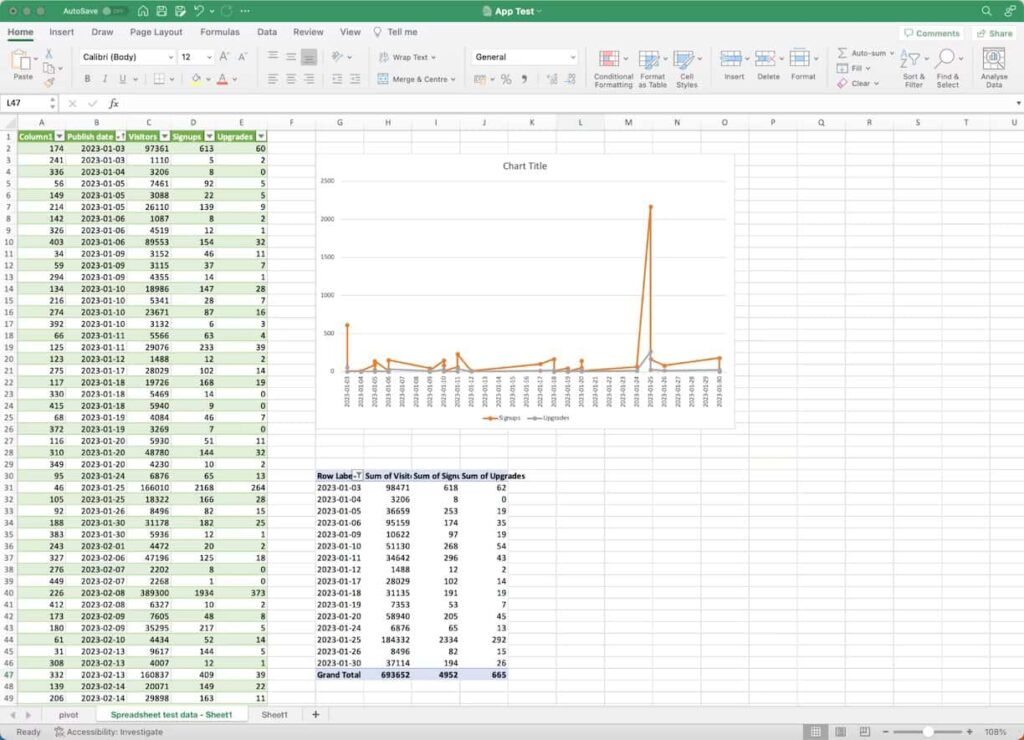

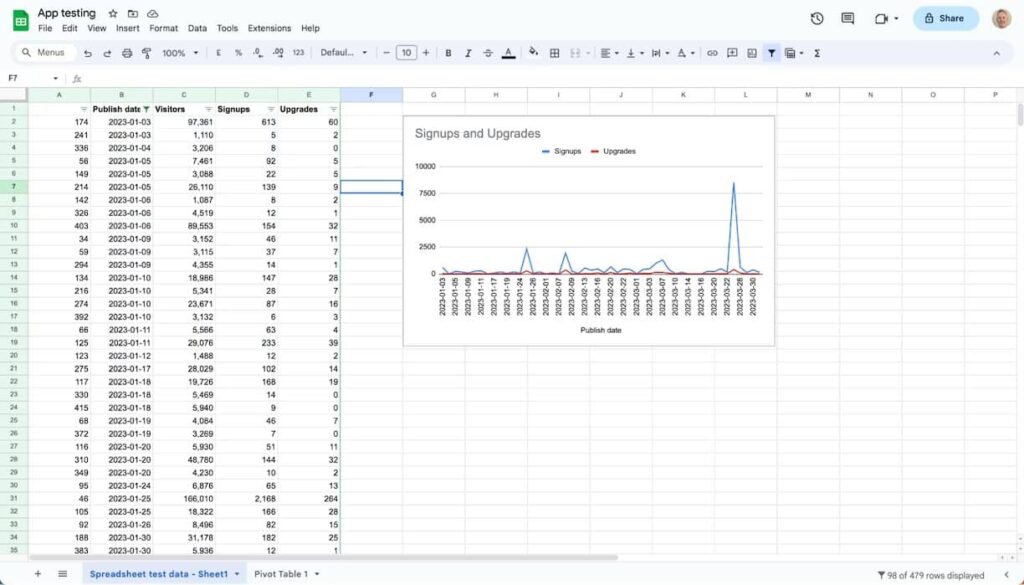

- Allows users to analyze data and create charts or graphs for better understanding.

- Provides flexibility to handle a wide range of financial tasks and projects.

3. Accounting Software:

Accounting software is designed to help businesses manage their financial records efficiently. It automates processes like tracking income, expenses, and payroll, making it easier to maintain accurate financial data.

The software also generates detailed reports, helping users monitor cash flow, balance sheets, and profit margins. Additionally, it ensures that businesses stay compliant with tax regulations, simplifying tax preparation and filing.

What Are The Benefits Of Using Spreadsheets In The Finance Department?

1. Streamlined Financial Processes:

- Simplifies budgeting by allowing easy tracking of income and expenses in one place.

- Automating repetitive tasks helps save time and effort by performing actions without the need for manual input, which also decreases the chance of making mistakes.

- This feature allows users to easily adjust financial plans whenever fresh information is received, ensuring that their strategies remain relevant and accurate.

- Allows for easy sharing of financial information among team members.

- Facilitates seamless integration with other financial tools and systems for better workflow.

2. Accurate Reporting and Forecasting:

Accurate reporting and forecasting are essential for making informed financial decisions. Spreadsheets allow users to compile data from various sources, making it easier to generate precise reports. Additionally, the ability to analyze past trends helps predict future financial performance, providing valuable insights for planning and budgeting.

3. Increased Efficiency and Productivity:

Boosting efficiency and productivity is essential for every finance department. Spreadsheets simplify processes by automating calculations, which cuts down on the time needed for manual data entry.

This lets finance professionals concentrate on important tasks, such as examining data and making smart decisions. With easy access to well-organized information, teams can work together more effectively and react quickly to any financial issues.

Is Excel A Powerful Software?

Excel is indeed a powerful software widely used for various tasks, especially in finance and data analysis. Its versatility allows users to perform complex calculations, create detailed reports, and analyze large datasets with ease. With a range of built-in functions and features, Excel supports data visualization through charts and graphs, making it easier to interpret information. Additionally, its ability to automate repetitive tasks through macros enhances efficiency and productivity.

1. Key Features of Excel:

- Advanced Formulas: Excel offers a variety of functions for complex calculations, including financial, statistical, and logical operations.

- Data Visualization: Users can create different types of charts and graphs to represent data visually, aiding in better understanding.

- Pivot Tables: This feature allows for quick data summarization and analysis, making it easy to draw insights from large datasets.

- Customizable Templates: Excel provides a range of templates that can be modified to meet specific project needs, ensuring flexibility.

- Collaboration Tools: Multiple users can work on the same file simultaneously, enhancing teamwork and information sharing.

Why Spreadsheet Programs Are Very Popular?

1. User-Friendly Interface:

Spreadsheet programs are known for their user-friendly interface, making them accessible to people of all skill levels. The layout is intuitive, allowing users to navigate easily between different features and functions.

With simple menus and toolbars, it’s straightforward to enter data and create calculations. This ease of use encourages more individuals to utilize spreadsheets for their personal and professional tasks.

2. Versatile Functionality:

- It helps with many tasks, including managing budgets, tracking expenses, analyzing data, and overseeing projects.

- Offers various built-in functions and formulas to perform complex calculations effortlessly.

- Users can design their own templates that fit their unique requirements, which makes their work processes smoother and more efficient.

- Provides tools for data visualization, helping to present information clearly through charts and graphs.

- Enables data sorting and filtering, making it easy to organize and retrieve information quickly.

3. Cost-Effective Solution:

Spreadsheet programs are a cost-effective solution for individuals and businesses alike. Many popular options are available for free or at a low cost, making them accessible to anyone. They eliminate the need for expensive software packages, allowing users to perform various tasks without breaking the bank. This affordability, combined with powerful features, makes spreadsheets an attractive choice for managing finances and organizing data efficiently.

FAQ’s

1. What are the advantages of using spreadsheet for managing personal finances?

Using spreadsheets for managing personal finances offers several advantages. They provide a clear way to track income and expenses, helping users see where their money goes each month. Additionally, spreadsheets allow for easy budgeting and financial planning, making it simple to set savings goals and monitor progress over time.

2. What is a spreadsheet program best used for?

A spreadsheet program is best used for organizing and analyzing data in a structured format. It excels at performing calculations, creating charts, and managing financial information, making it ideal for tasks like budgeting, accounting, and data tracking.

5. Which spreadsheet tool is considered one of the most powerful and popular applications, featuring advanced tools for statistical analysis?

Microsoft Excel is a widely used spreadsheet application known for its strength and popularity. It provides powerful tools for statistical analysis, enabling users to carry out complex calculations and make smart choices based on data trends.

4. What is the main function of spreadsheet?

A spreadsheet’s main job is to arrange and handle data in a table format with rows and columns. This setup helps users do calculations, analyze details, and create charts or graphs, making it simpler to understand and work with the information.

5. What are the 5 functions in a spreadsheet?

Five common functions in a spreadsheet include SUM, which adds up a range of numbers, and AVERAGE, which calculates the mean of a set of values. Other functions like COUNT, which tallies entries, MAX, which finds the highest number, and MIN, which identifies the lowest value, help users analyze data effectively.

Conclusion:

Spreadsheet software stands out as a versatile tool that offers unparalleled power in managing data and performing calculations. Its flexibility allows users to tailor their workspaces to meet specific needs, making it suitable for a variety of tasks beyond just financial planning.

With advanced functions and features, spreadsheets provide a comprehensive approach to data analysis, enabling informed decision-making. Ultimately, the combination of usability and functionality makes spreadsheet software an invaluable asset for anyone looking to organize their financial information effectively.