Having the right tools makes personal money management much easier, though it can still feel daunting at times. In today’s digital age, there are numerous personal finance software alternatives available, many of which are completely free. Without breaking the bank, these tools are designed to help you manage your spending, create a budget, save for your goals, and gain a better understanding of your financial situation. To help you manage your finances with ease, we’ll review the best free personal finance software in this post.

The best free personal finance apps, like Mint and YNAB, can help you effectively track your spending and manage your budget. You can achieve your financial goals more successfully and realize your full financial potential by using these tools.

Exploring The Advantages Of Free Personal Finance Software

The best free personal finance software gives users the ability to take charge of their finances without paying a monthly fee by offering essential tools for financial planning, expense tracking and budgeting. These services are easy to use, available on all devices, and often offer automatic transaction syncing and goal setting to help you reach your full financial potential. Free software solutions, which prioritize security and privacy, let users test options without making a commitment, making it easier to choose the best option for their budget.

| Advantage | Description |

| Cost-Effective | No fees required, making it accessible to everyone, upcycling on a tight budget. |

| Comprehensive Budgeting | Provides tools to categorize expenses and set budget limits to better manage money. |

| Expense Tracking & Categorization | Automatically tracks and categorizes transactions for detailed financial insights. |

| Goal Setting | Helps set financial goals (eg, saving, paying off debt) and tracks progress. |

| Automated Transaction Syncing | Syncs with bank accounts and credit cards for real-time financial updates. |

| User-Friendly Interfaces | Intuitive design for easy navigation and use, suitable for all experience levels. |

| Privacy & Security | Protects sensitive financial data with security safeguards and encryption. |

| Cross-Device Accessibility | Get access on desktop, mobile and tablet for easy, on-the-go money management. |

| No Commitment | Allows users to explore multiple software options without long-term contracts. |

| Community & Support | Provides access to forums, FAQs, and customer support to help users resolve issues. |

Key Takeaways:

- Managing your finances is very important in today’s fast paced world.

- The top free personal finance software provides powerful tools for budgeting, expense tracking, and saving—all for free.

- These tools help you take control of your financial future without the need for expensive programs or subscriptions.

- By using these free software options, you can easily unlock your financial potential with better money management.

- Whether you’re a beginner or seasoned in personal finance, these tools can simplify organization and decision-making for long-term success

How Free Software Can Simplify Budgeting And Expense Tracking

1. Real-Time Expense Tracking:

Real-time expense tracking is one of the most important benefits of using free software for budgeting and financial management. Here’s how it simplifies the process:

- Automated Tracking: Many free budgeting tools allow users to link their bank accounts and credit cards. It enables automatic import of transactions, significantly reducing manual entry of expenses. As transactions occur, they are recorded instantly, ensuring that customers always have an up-to-date view of their financial situation.

- Categorization: Free software includes a number of features that automatically categorize items into pre-determined groups (eg, grocery, entertainment, utility). This automation allows users to see where their spending is going in real-time, making it possible to easily match spending habits and fields.

- Alerts and Notifications: Users can set up alerts for specific spending thresholds or unusual transactions. These notifications help users stay on top of their finances and prompt them to take action if they reach their budget limit.

- Better decision-making: With real-time data at their fingertips, consumers can make informed decisions faster. For example, if they notice that they are spending more in a certain category, they can adjust their spending behavior immediately, rather than waiting until the end of the month to analyze their budget.

2. Streamlining Monthly Budgeting:

Streamlining monthly budgeting is another major benefit of using free software, as it simplifies the entire budgeting process. Here is the method:

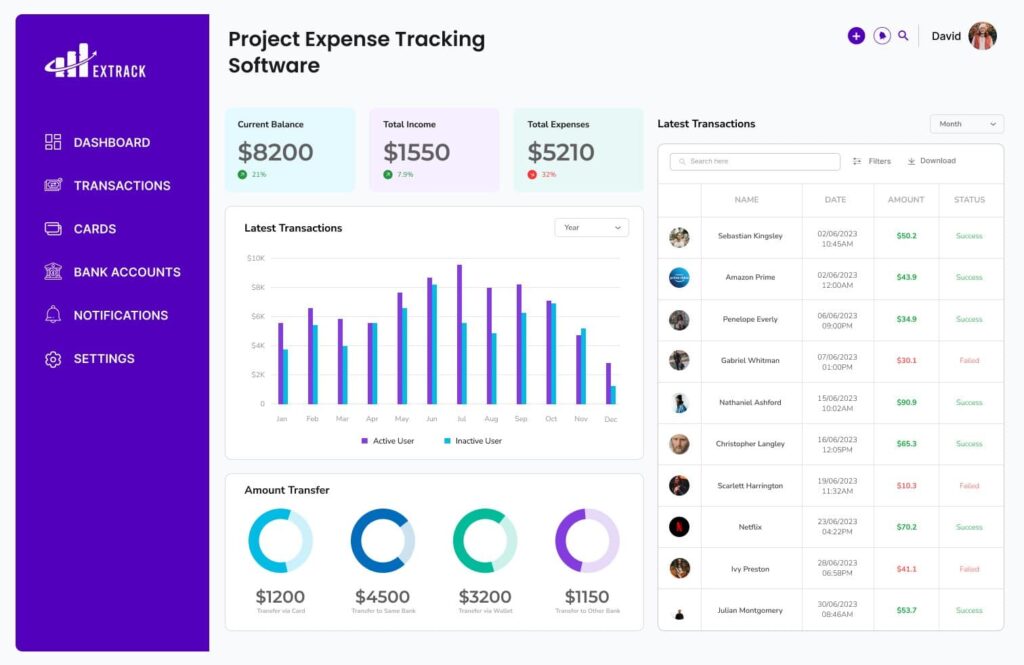

- User-friendly interface: Many free budgeting tools are designed with simplicity in mind, with intuitive dashboards that allow users to easily create and manage their budgets. This ease of use reduces the time and effort required to set up and maintain a monthly budget.

- Custom Budget Categories: Users can easily customize their budget categories to reflect their personal or organizational needs. This customization helps ensure that the budget is in line with actual spending habits and financial goals.

- Visual representations: Free budgeting software often provides visual tools, such as graphs and charts, that help users quickly understand their financial situation. The visual representation of data allows easy identification of trends and areas that may require attention.

- Regular updates: Many free tools allow users to set recurring expenses and income, making it easy to keep the budget updated with expected cash flow. This feature helps users maintain a realistic budget based on their actual financial situation.

- Comprehensive Reporting: At the end of each month, users can generate reports that summarize their spending, savings and budget performance. These reports provide insights that can help users improve their budgeting strategies for the next month.

Best Free Personal Finance Software for Money Management

When it comes to managing personal finances effectively, choosing the best free personal finance software can make a significant difference. These tools simplify budgeting, expense tracking and investment management, empowering users to take control of their financial health.

- Mint: A popular app that combines bank accounts, credit cards, and investments for a comprehensive financial overview. It automates expense classification and sends bill reminders.

- YNAB (You Need a Budget): Focuses on active budgeting, encouraging users to allocate every dollar. It offers a free trial and extensive educational resources.

- Personal Capital: Combines budgeting with investment tracking, allowing users to assess portfolios and plan for retirement.

- GnuCash: An open-source software with double-entry accounting, suitable for detailed financial tracking and invoicing.

- Every Dollar: Created by Dave Ramsey, it simplifies zero-based budgeting with a user-friendly interface for tracking expenses.

- GoodBudget: A digital envelope budgeting system that helps users visually allocate money and track expenses easily.

- PocketGuard: Helps users understand disposable income by tracking spending against bills and goals.

| Software | Key Features | Unique Offerings |

|---|---|---|

| Mint | Links accounts; automatic classification; Bill sends a reminder. | Comprehensive financial overview with an intuitive dashboard. |

| YNAB | Functional budgeting; Allocates every dollar; Educational resources | Emphasizes financial literacy and community support. |

| Personal Capital | Combines budgeting with investment tracking. | Budgeting as well as in-depth investment analysis. |

| GnuCash | open source; double entry accounting; Receipt | Full control over personal accounting with customization. |

| EveryDollar | zero-based budgeting; User friendly interface. | Built on Dave Ramsey’s philosophy for intentional spending. |

| GoodBudget | Digital Envelope Budget; Visual allocation | Promotes better spending habits through a visual approach. |

| PocketGuard | track expenses against bills; Focuses on disposable income. | Helps identify available cash to spend. |

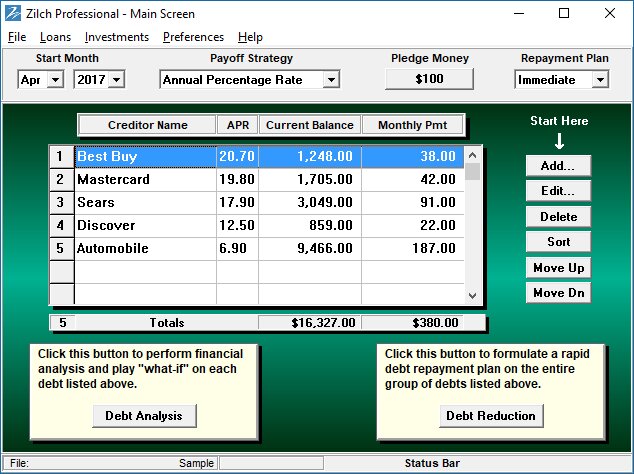

Debt Management And Reduction with No Cost Fiscal Tools

2. Investment Portfolio Recommendations:

Consumers can mitigate risk and enhance their wealth by utilizing complimentary personal finance tools. These resources analyze individual financial goals and risk tolerance, offering insights into historical performance and potential returns across different asset allocations.

2. Automated Savings Calculation:

This feature streamlines the establishment and tracking of savings objectives. It calculates the necessary contributions based on user-defined goals. With automated options like Roundup Savings, users can effortlessly transfer spare change into their savings accounts. These programs not only promote regular saving habits but also help users analyze their spending patterns to achieve their financial aspirations.

FAQ’s

1. How Can Personal Financial Software Aid Your Financial Decisions?

Using personal finance software to track income and expenses increases your ability to make informed financial choices. By analyzing spending patterns, it helps you set goals and budget effectively.

2. What Is Personal Finance Software Used For?

Personal finance software is designed for budgeting, expense tracking, bill management, and investment monitoring. It assists users in planning financial goals and managing their money efficiently.

3. What Is The Best Software For Financial Management?

The ideal financial management software varies based on individual goals; options like Mint, YNAB, and Personal Capital are popular for their investment and budgeting features. Each tool offers unique functionalities to support effective money management.

4. How Can I Achieve Good Personal Finance?

Good personal finance encompasses setting savings goals, tracking spending, and maintaining a budget. Personal finance software can simplify these processes and enhance financial awareness.

5. What Types Of Software Are Used In Finance?

Common software types in finance include financial planning tools, accounting applications, investment platforms, and budgeting software. These tools address various aspects of financial management for both individuals and businesses.

Conclusion:

Utilizing top free personal finance software can significantly enhance your ability to make sound financial decisions and manage your finances. These resources provide valuable insights into saving, spending, and budgeting, empowering you to establish and achieve your financial goals. By leveraging these tools, you can maximize your financial potential and work toward a more secure financial future.